Candlestick Quick Guide.pdf - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Abandoned Occurs at the bottom of a chart formation.

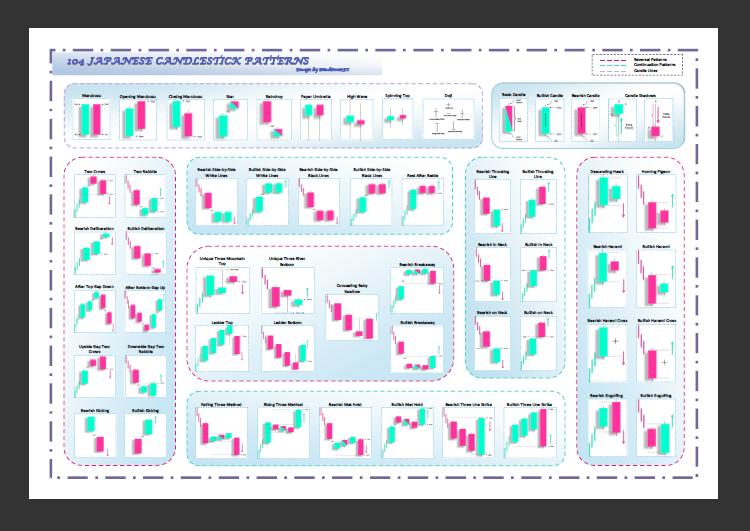

Did you click here first? If you did, stop reading right now and go through the entire Japanese Candlesticks Lesson first! If you’re REALLY done with those, here’s a quick one-page reference cheat sheet for single, dual, and triple Japanese candlestick formations.

This cheat sheet will help you to easily identify what kind of candlestick pattern you are looking at whenever you are trading. Go ahead and bookmark this page No need to be shy!

Number of Bars Candlestick Name Bullish or Bearish? What It Looks Like? Single Neutral Neutral Bullish Bearish Bullish Bearish Bullish Bearish Number of Bars Candlestick Name Bullish or Bearish? What it Looks Like? Double Bullish Bearish Bearish Bullish Triple Bullish Bearish Bullish Bearish Bullish Bearish.

1 A Candlestick Primer By Tom Bierovic 2 Introduction Although centuries old, Japanese candlestick charts are relatively new to the West: Steve Nison introduced them here in 1991 in his book, Japanese Candlestick Charting Techniques. The candles provide the same price information (open, high, low, and close) that bar charts do, but they display that information in a more visually appealing, more meaningful way. In this e-book, you ll learn how to read candlesticks and how to identify the most important candlestick patterns.

The first slide presents a daily candlestick chart, the second introduces the terminology for a candlestick s components, and the third shows how to read a candlestick. The rest of the e- book describes and illustrates many useful candlestick patterns. 3 Japanese Candlestick Chart 4 Components of Japanese Candlesticks 5 Reading Japanese Candlesticks 6 Bullish and Bearish Engulfing Lines A bullish engulfing line, which occurs in a downtrend, is a tall, white real body that engulfs the previous session s smaller, black real body. The bullish engulfing line opens below the previous session s close and closes above the previous session s open. A bearish engulfing line occurs in an uptrend.

Nitgen hfdu06m driver download related softwares for pc games. Its tall, black real body engulfs the previous session s smaller, white real body. In other words, a bearish engulfing line opens above the previous session s close and closes below the previous session s open. 7 Bullish Engulfing Line 8 Bearish Engulfing Line 9 Piercing Line and Dark Cloud Cover A piercing line is a tall white candle that follows a tall black candle in a downtrend. It opens below the previous candle s low but closes at least halfway into the previous candle s real body. A dark cloud cover is a tall black candle that follows a tall white candle in an uptrend. It opens above the previous candle s high but closes at least halfway into the previous candle s real body.

A piercing line is bullish, and a dark cloud cover is bearish. 10 Piercing Line 11 Dark Cloud Cover 12 Tower Bottoms and Tower Tops A tower bottom begins with a tall black candle in a downtrend. It s followed by a series of smaller real bodies that trade sideways. Finally, a tall white candle forms the second tower, completing the pattern.

A tower top begins with a tall white candle in an uptrend. It s followed by a series of smaller real bodies that trade sideways. Finally, a tall black candle forms the second tower, completing the pattern. A tower bottom is bullish, and a tower top is bearish. 13 Tower Bottom 14 Tower Top 15 Rising Three and Falling Three A rising three pattern begins with a tall white candle in an uptrend. It s followed by three small real bodies (usually black) that hold within the white candle s range.

A tall white candle that closes above the high of the first white candle completes the pattern. A falling three pattern begins with a tall black candle in a downtrend. It s followed by three small real bodies (usually white) that hold within the black candle s range. A tall black candle that closes below the low of the first black candle completes the pattern. A rising three pattern is bullish; a falling three pattern is bearish. 16 Rising Three 17 Falling Three 18 Morning Star and Evening Star A morning star, which occurs in a downtrend, consists of three candles: a tall, black real body, a small real body (either white or black) that gaps open below the real body of the first candle, and a tall white candle with a strong close at least halfway into the first candle s real body.

An evening star is a three-candle pattern in an uptrend: a tall, white real body, a small real body (either white or black) that gaps open above the real body of the first candle, and a tall black candle with a close at least halfway into the first candle s real body. A morning star is bullish; an evening star is bearish.